Bitcoin Halving and Tokenomics

Bitcoin’s economic model represents one of the most revolutionary aspects of its design. At the heart of this model lies the Bitcoin halving – a predetermined event that systematically reduces the rate at which new bitcoins are created. This article explores Bitcoin’s unique monetary policy, the halving mechanism, and the economic principles that make Bitcoin a compelling alternative to traditional currencies.

Understanding Bitcoin's Supply Mechanism

Unlike traditional currencies that can be printed indefinitely by central banks, Bitcoin has a fixed supply cap of 21 million coins. This fundamental characteristic establishes Bitcoin as a deflationary asset with a predictable issuance schedule – a stark contrast to the inflationary nature of fiat currencies.

The Controlled Emission Schedule

Bitcoin’s creator, Satoshi Nakamoto, programmed a precise schedule for releasing new bitcoins into circulation:

- New bitcoins are created with each new block (approximately every 10 minutes)

- The rate of new bitcoin creation follows a geometric series

- The supply is algorithmically controlled and cannot be altered without network consensus

- Approximately 19 million bitcoins (90% of the total supply) have already been mined

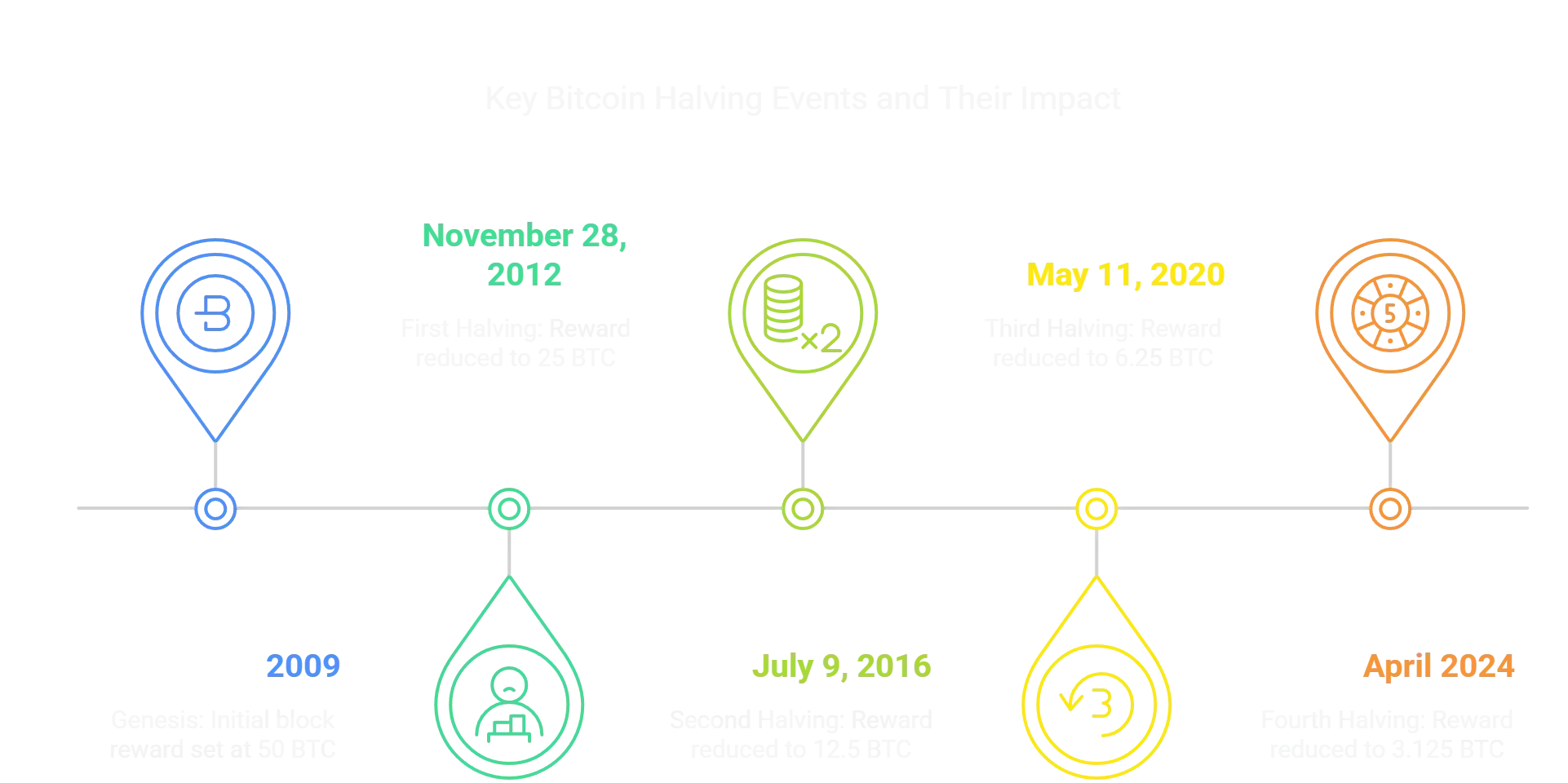

What is the Bitcoin Halving?

The Bitcoin halving (sometimes called "halvening") is a pre-programmed event that cuts the block reward for miners in half. This event occurs approximately every four years, or more precisely, every 210,000 blocks.

Future halvings will continue this pattern until approximately the year 2140, when the final bitcoin will be mined.

The Mathematics Behind Halving

The halving mechanism follows a straightforward mathematical formula:

- Initial block reward: 50 BTC

- Block reward formula: 50 × (1/2)^(n), where n is the number of halvings

- Total bitcoin supply: ∑ [210,000 × 50 × (1/2)^(n)] from n=0 to n=33

- Final result: 21 million BTC (technically 20,999,999.9769 BTC due to rounding)

Economic Implications of the Halving

The halving mechanism creates several significant economic effects:

1. Supply Shock

Each halving represents a 50% reduction in new supply entering the market. This supply shock has historically preceded significant price appreciation, though past performance does not guarantee future results.

2. Increasing Scarcity

With each halving:

- The stock-to-flow ratio (existing supply divided by new supply) doubles

- Bitcoin becomes increasingly scarce relative to its existing supply

- The inflation rate (new supply as a percentage of existing supply) is cut in half

3. Mining Economics

The halving directly impacts miners, who see their block reward compensation reduced by 50%:

- Miners must adapt to reduced revenue streams

- Less efficient mining operations may become unprofitable

- Mining difficulty typically adjusts as the competitive landscape changes

- Transaction fees become increasingly important for miner revenue

Bitcoin's Tokenomics Model

Tokenomics refers to the economic model that governs a cryptocurrency’s creation, distribution, and function within its ecosystem. Bitcoin’s tokenomics are characterized by several key principles:

1. Fixed Supply Cap

The 21 million cap creates digital scarcity, a foundational characteristic that makes Bitcoin valuable:

- No authority can increase the supply beyond this limit

- Lost bitcoins reduce the effective circulating supply permanently

- As demand increases against fixed supply, purchasing power theoretically increases

2. Diminishing Inflation Rate

Bitcoin’s inflation rate (the percentage of new supply added annually) continuously decreases:

- Initial inflation rate: approximately 7-8% annually

- Current inflation rate (2024): approximately 1.5% annually

- After the 2024 halving: approximately 0.8% annually

- By 2140: effectively 0% inflation

3. Divisibility

While the supply cap is fixed, each bitcoin is highly divisible:

- One bitcoin can be divided into 100 million units

- The smallest unit (0.00000001 BTC) is called a satoshi or "sat"

- This divisibility ensures usability even at much higher valuations

4. No Centralized Control

Bitcoin’s monetary policy is:

- Predetermined by the protocol

- Transparent and verifiable by anyone

- Immutable without overwhelming consensus

- Decentralized with no central authority able to alter it

The Stock-to-Flow Model

One popular framework for understanding Bitcoin’s value proposition is the Stock-to-Flow (S2F) model, which analyzes Bitcoin as a scarce commodity like gold or silver:

- Stock: The existing supply (currently ~19 million BTC)

- Flow: The new supply created annually (currently ~328,500 BTC per year)

- S2F Ratio: Stock divided by flow (currently ~58)

Halving and Market Psychology

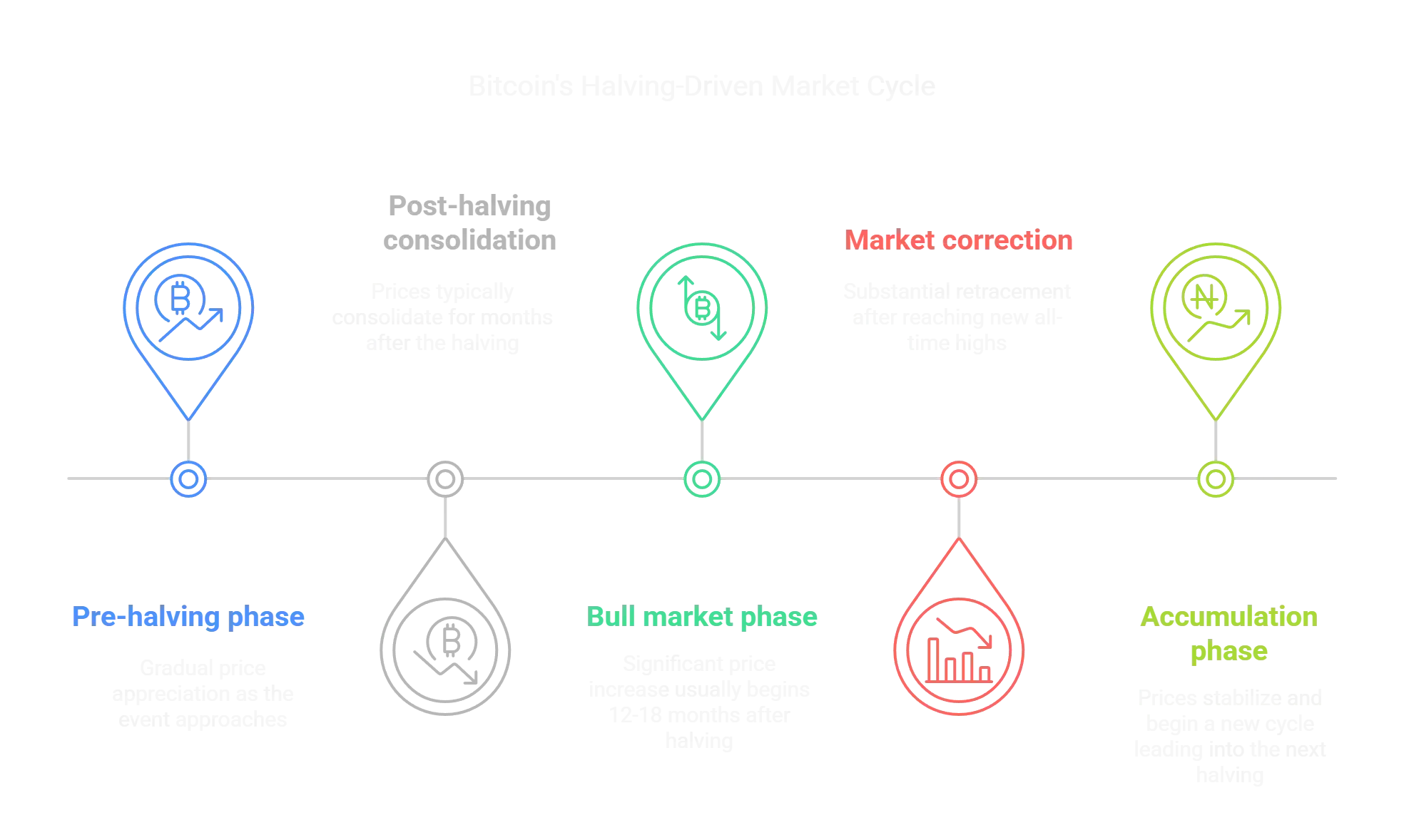

Beyond pure economics, halvings impact market psychology in several ways:

1. Anticipation and Speculation

- Investors often position themselves before halvings in anticipation of supply reduction

- Media coverage increases awareness and potentially drives new demand

- Market participants debate whether the halving is “priced in”

2. Narrative Reinforcement

- Halvings reinforce Bitcoin’s scarcity narrative

- They provide regular “focal points” that remind the market of Bitcoin’s unique monetary policy

- The predictable schedule contrasts with the often opaque decision-making of central banks

3. Long-term Holder Behavior

Data suggests that long-term holders typically:

- Accumulate before halvings

- Hold through the event and subsequent market cycles

- Use halvings as reference points for investment strategies

Post-Halving Market Cycles

While these patterns have been observed in previous cycles, market dynamics are complex, and future cycles may differ from historical precedents.

The Transition to a Fee Market

As block rewards diminish with each halving, Bitcoin’s security model will gradually transition:

- Current state: Block rewards provide the majority of miner income

- Future state: Transaction fees will need to replace block rewards as the primary incentive

- Competing priorities: Security needs vs. keeping fees reasonable for users

- Layer 2 solutions: May impact fee dynamics on the main chain

Criticisms and Challenges

Bitcoin’s halving mechanism and tokenomics model face several criticisms:

1. Long-term Security Concerns

- Will transaction fees be sufficient to secure the network when block rewards become minimal?

- Could diminishing rewards lead to security vulnerabilities?

2. Mining Centralization Pressure

- Halvings pressure less efficient miners, potentially increasing centralization

- Geographic concentration of mining could be exacerbated

3. Price Volatility

- Irregular supply reductions could contribute to Bitcoin’s price volatility

- Market anticipation of halvings may create speculative bubbles

Conclusion

Bitcoin’s halving mechanism and broader tokenomics model represent a pioneering approach to digital money. By creating a transparent, predictable monetary policy with a fixed supply cap and diminishing issuance rate, Bitcoin offers an alternative to the discretionary monetary policies of central banks. The halving serves as both a practical mechanism for controlling supply and a powerful reminder of Bitcoin’s unique value proposition. As each halving reduces the inflation rate further, Bitcoin continues its programmatic path toward becoming an increasingly scarce digital asset. Understanding these economic principles provides crucial context for anyone considering Bitcoin as an investment, a technology, or a potential evolution of money itself. Whether Bitcoin’s monetary experiment ultimately succeeds in the long term remains to be seen, but its innovative approach to digital scarcity has already influenced economic thinking and spawned an entire industry.