Let’s look at the project that many consider to be Render Killer with under a $100M marketcap at the moment of writing of this article.

1. Understand the project’s fundamentals:

Problem & Solution:

Growing number of applications/use cases that require a lot of processing power (AI/ML, 3D rendering for games/videos, crypto mining). Lack of accessible GPU computing power.

Clore.ai is a distributed supercomputer with GPUs available for rent. Decentralized GPU marketplace provides access to computing resources based on computing power, price, performance and memory.

Whitepaper:

Clore runs its own blockchain that employs the Kawpow consensus algorithm which is a type of PoW algorithm. The reason being is to protect the network against ASICs miners. Instead miners need to use consumer types GPUs like NVIDIA or AMD GPUs.

I couldn’t find the “whitepaper” but there is a Proof-Of-Holding whitepaper that describes the benefits of holding Clore coins which we’ll talk more about in the tokenomics part.

Tokenomics:

Clore coin:

- Facilitates payment on the platform

- Earns rewards for holding (read below)

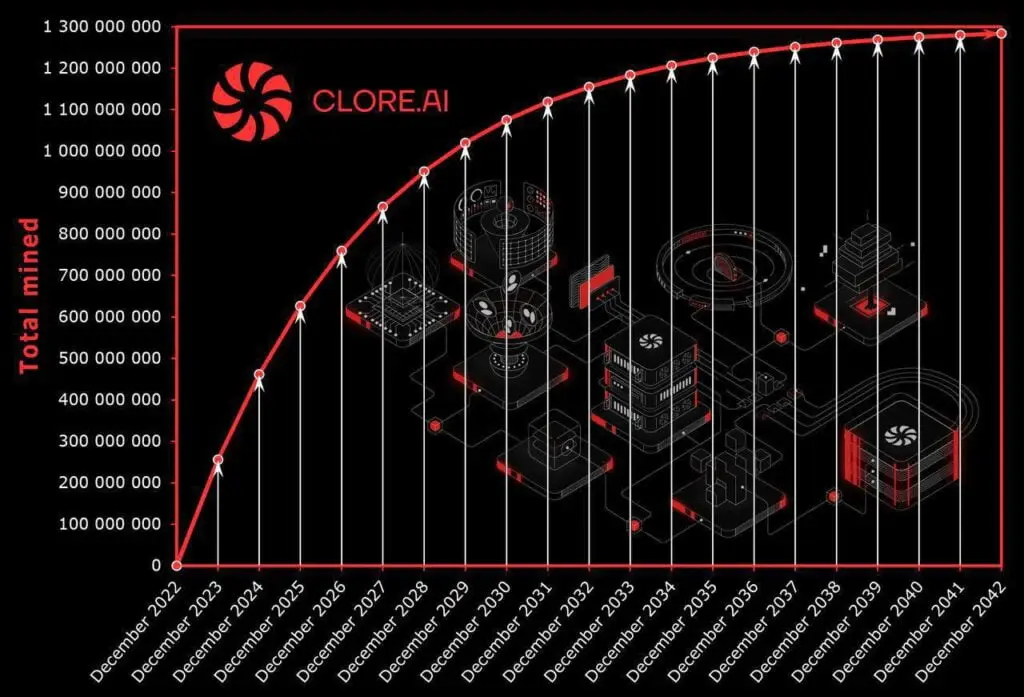

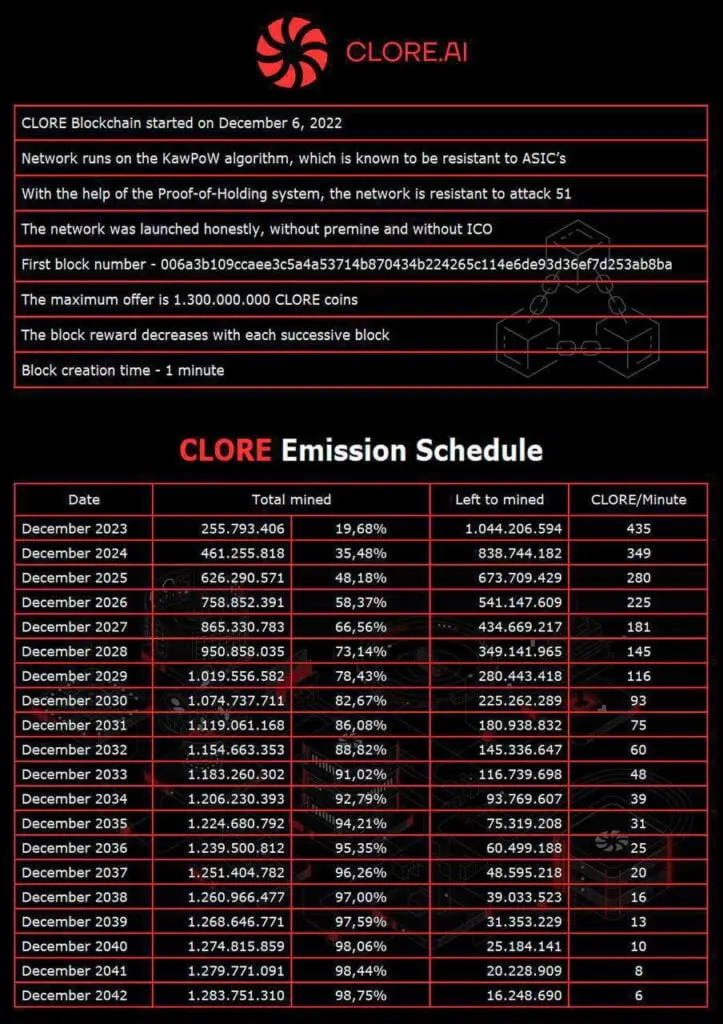

The max supply is 1.3B coins that are to be fully mined in 20 years mining is the only source of added supply. 300m coins in circulation represent around 23% of max supply at the moment.

The halving (reduction in mining rewards) is happening with every block. So every block reduces mining size making it more scarce.

Now back to the Proof-Of-Holding whitepaper.

The Clore Coin is used as a preferred method of payment for renting the GPUs along with BTC and USD. But the holders of Clore coin will get reduced marketplace fees up to 50%.

Clore.ai hosting providers will get more Clore coins as an additional reward to payments they receive for leasing their equipment. It is proportionate to the amount of Clore they hold to incentivize the holding of Clore.

In addition the holders of Clore will be getting airdrops such as the one distributed in July 2023 where 1.5% of coins were distributed to the holders of Clore.

In addition, holders get increased mining bonuses, no penalties and no lockups.

2. Evaluate the team & community:

Team:

No info found.

Community:

Twitter – 19.4k followers, they are relatively active with 2-3 posts a day.

Telegram – 4.5k followers, very active discussions.

Discord – community is not very active, mainly technical support channels and trade talks.

Youtube – 375 subscribers and 3 videos so far.

Advisors:

No info found.

Partnerships:

No info found.

3. Assess the market & competition:

Market fit:

With the increased demand in computing power the market size is huge. Artists, content creators, game developers, movie makers, miners, AI/ML projects.

Competition:

Render is a top 100 crypto with a current market cap of $2.6B.

Akash Network is also a top 100 crypto with a $900K market cap.

Market cap & liquidity:

The current circulating supply as of Feb 21st is around 300,000,000 coins at the current price $0.23 puts it at around $69m in market cap.

4. Stay informed & cautious:

Roadmap:

The team has pretty much delivered what is listed on the roadmap on time.

Upcoming:

Q1 2024 – “Clore Storage will be introduced, where users can rent storage spaces for containers on clore.ai, which will be useful for data sharing between containers.”

Q2 2024 – “We will release Clore VPN, potentially allowing clore.ai hosting providers to lease their network as a VPN service”

Q3 2024 – “CLORE OS will be released with additional server monitoring features like GPU clock speeds, temperatures, and loads.”

Additional (but probably missing earlier) info:

Clore.ai is a company registered in the Czech Republic.

Clore.ai purchased a whole data center in May 2023. So users will be able to use it as a Clore Storage (mentioned earlier) service to rent storage space.

And because of that purchase they also offer Clore Secure Cloud with Enterprise grade reliability because of their own data center. So you’ll be able to use either a distributed peer-to-peer network or their own secure cloud, which kind of defeats the decentralization but you still have a choice to use Community cloud.

Clore hosting providers can set up their idle equipment to mine cryptocurrency such as Ergo, Radiant, Zilliqa, that automatically gets converted into Clore coins. The mining is automatically switched to the most profitable coin at the moment, or you can set up a specific coin mining with a command.

Where to buy:

Currently Clore is Available on a few CEXs:

Gate.io

MEXC

XT.com

Bitget

And a few others

Wallets:

There is a native wallet available for desktop on Windows and Linux. 3rd party wallet: Vidullum.

No support for cold wallets at the moment.

Links:

Website: https://www.clore.ai/

Blockchain explorer: https://clore.cryptoscope.io/

Wallets: https://clore.ai/wallet

Overview: https://clore.ai/clore-overview.pdf

Proof-of-Holding Whitepaper: https://clore.ai/assets/pdf/Proof-Of-Holding-Whitepaper.pdf

Remember:

Investing in crypto involves significant risk. Prices can fluctuate dramatically, and projects can fail entirely. This content is for informational purposes only and shouldn’t be considered financial advice. Do your own research, understand the risks, and never invest more than you can afford to lose.

Disclaimer:

The information provided on this website is accurate as of the last edited date. However, please be aware that circumstances can change, and the content may no longer be accurate or up-to-date. None of the information presented here constitutes financial advice. Always consult with a qualified professional before making any financial decisions.