Bitcoin's Proof-of-Work Consensus

The Problem of Consensus in Decentralized Systems

- Network participants (nodes) must agree on which transactions occurred and in what order

- No central authority exists to enforce the rules

- Some participants might attempt to cheat the system (e.g., double-spend coins)

- Communication occurs over the open internet, where messages can be delayed or corrupted

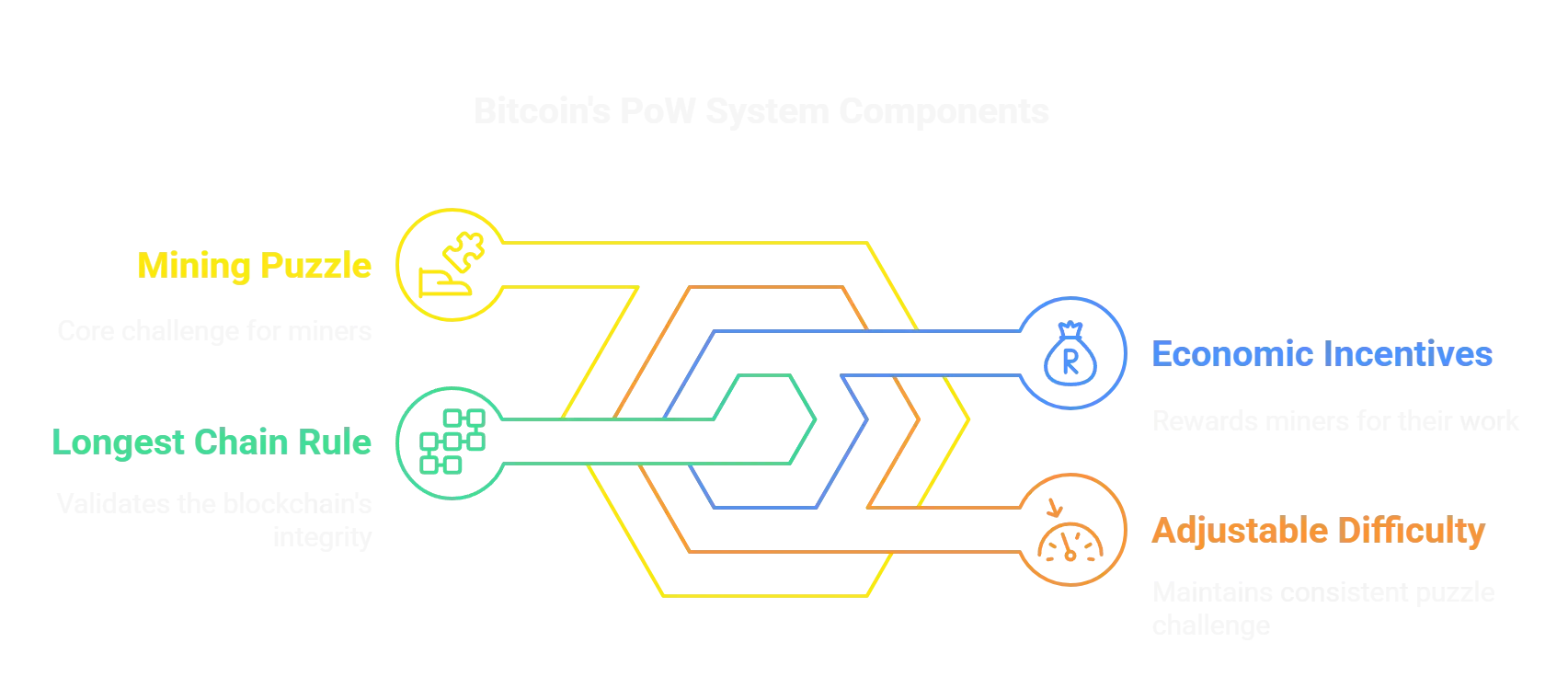

What is Proof-of-Work?

- The Mining Puzzle: Miners compete to find a specific output from a cryptographic hash function

- Adjustable Difficulty: The network automatically adjusts how hard this puzzle is

- Economic Incentives: Successful miners receive block rewards and transaction fees

- Longest Chain Rule: The chain with the most accumulated work is considered valid

Together, these elements create a system where attacking the network becomes prohibitively expensive, while honestly participating becomes potentially profitable.

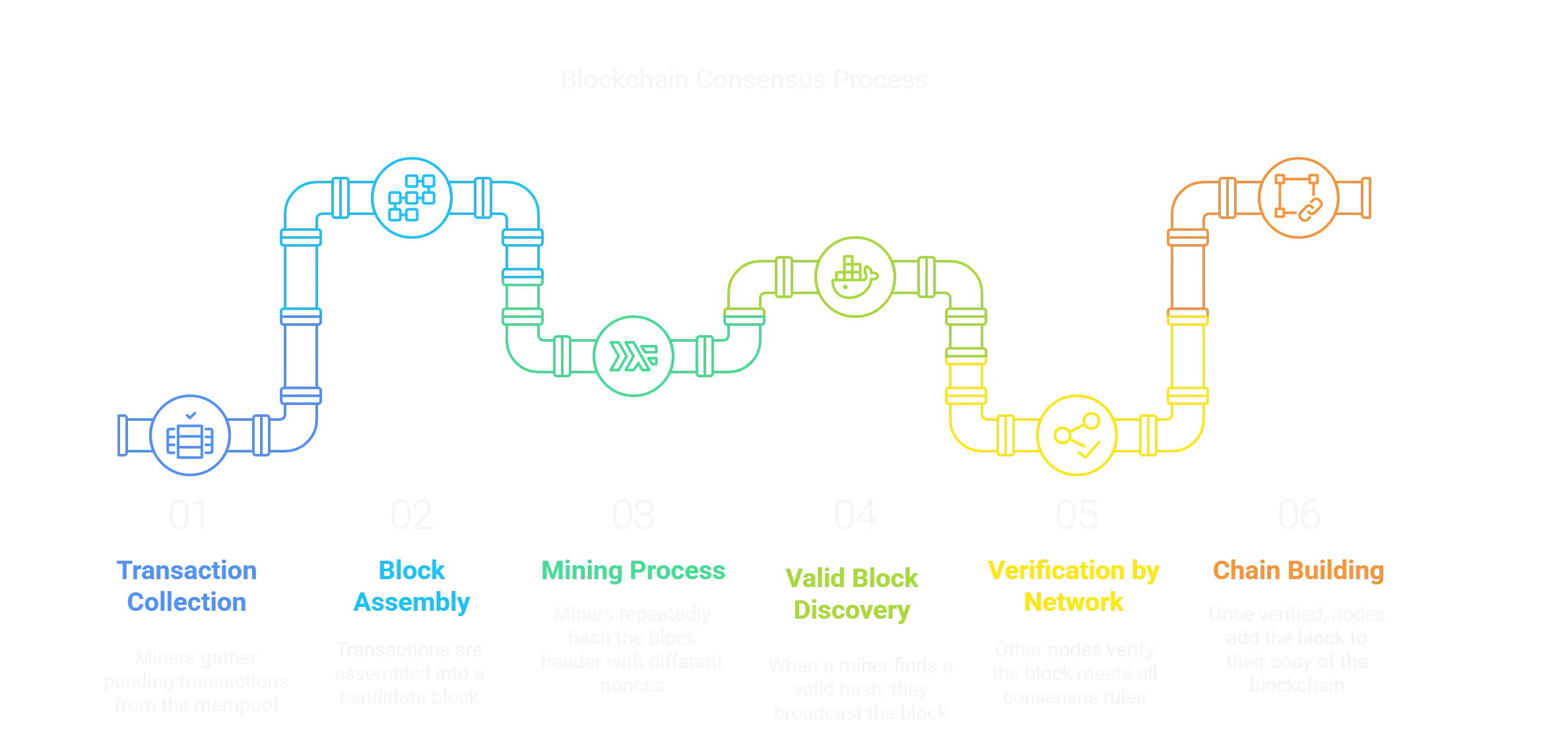

How Bitcoin's PoW Consensus Works: A Technical Overview

1. The Hashing Challenge

- The hash must be below a target value (or equivalently, begin with a certain number of zeros)

- Miners can only modify the "nonce" value to generate different hashes

- Each attempt has an equal, random chance of success

- The only way to find a valid hash is through brute force (trying different nonces)

2. Block Creation Process

3. Difficulty Adjustment

- Every 2,016 blocks (roughly two weeks), the network recalculates the target

- If blocks were produced too quickly, difficulty increases

- If blocks were produced too slowly, difficulty decreases

- The adjustment is proportional to the deviation from the target time

Why PoW Matters: Security Properties

1. Sybil Resistance

- Making influence proportional to real-world resources (computational power)

- Requiring provable resource expenditure rather than easily faked identities

- Creating a cost to participation that scales with network influence

2. Immutability and Finality

- An attacker would need to redo the Proof-of-Work for that block

- And for all subsequent blocks

- While simultaneously outpacing the honest network’s ongoing work

3. Objective Consensus

- The "longest chain rule" (more precisely, the chain with the most accumulated work) provides an objective metric

- New nodes need only the protocol rules, not a list of trusted authorities

- This property enables Bitcoin’s trustless nature

4. Decentralized Issuance

- Distributes new bitcoin issuance to miners worldwide

- Creates a competitive market for efficient mining

- Enables permissionless participation in the minting process

The Energy Question: PoW's Environmental Impact

Current Energy Usage

- Bitcoin’s annual electricity consumption is estimated between 100-150 TWh

- This represents approximately 0.5% of global electricity production

- Electricity constitutes miners’ largest operational cost

Contextualizing the Energy Consumption

- Energy Mix Considerations

- Studies suggest 40-75% of Bitcoin mining uses renewable energy

- Miners actively seek the cheapest energy sources, increasingly renewables

- Mining can utilize energy that would otherwise be wasted (stranded energy)

- Value Provided Per Unit Energy

- Bitcoin provides a censorship-resistant monetary network

- Energy secures trillions in transaction value annually

- Comparison to other financial systems must account for full infrastructure costs

- Geographic Flexibility

- Unlike many industries, Bitcoin mining can locate anywhere with electricity

- This allows utilization of energy in remote locations far from population centers

- Miners can serve as “buyers of last resort” for excess renewable energy

Mining Efficiency Trends

- Mining hardware efficiency (hashes per watt) has improved by over 100x since 2013

- Economic incentives continuously drive more efficient mining technology

- Energy costs dominate mining economics, creating pressure for optimization

PoW Alternatives and the Consensus Debate

Proof-of-Stake (PoS)

- Validator selection based on cryptocurrency holdings rather than computational work

- Significantly reduced energy consumption

- Potential centralization risks from capital concentration

- Different security assumptions and attack vectors

- Used by Ethereum and many other cryptocurrencies

Hybrid Models

- Combining elements of PoW and PoS

- Attempting to balance security with efficiency

- Examples include Decred’s hybrid system

Bitcoin's Stance

- It has the longest security track record (14+ years without compromise)

- The security model is well-understood and battle-tested

- The energy expenditure is viewed as a feature, not a bug – creating real-world cost to attack

- Changing consensus mechanisms would risk Bitcoin’s fundamental security properties

Common Criticisms and Responses

Criticism 1: "PoW is wasteful energy consumption"

Criticism 2: "PoW leads to mining centralization"

Criticism 3: "PoW creates e-waste from mining hardware"

Criticism 4: "PoW cannot scale to global payment volumes"

The Future of Bitcoin's Consensus

1. Mining Decentralization Efforts

- Continued geographic distribution of mining operations

- Home mining initiatives leveraging excess heat for residential use

- Mining pool innovations to prevent centralization risks

2. Layer 2 Scaling Solutions

- Building higher-throughput systems secured by the PoW base layer

- Lightning Network and other second-layer technologies

- Sidechains with alternative consensus models anchored to Bitcoin

3. Energy Innovation

- Integration with renewable energy production

- Capturing stranded and wasted energy sources

- Advanced cooling technology to improve efficiency

4. Soft Fork Improvements

- Potential protocol upgrades that maintain PoW while enhancing capabilities

- Privacy improvements that maintain verifiability

- Smart contract functionality through carefully designed additions

Conclusion

Bitcoin’s Proof-of-Work consensus mechanism represents one of the most significant innovations in distributed systems design. By creating a system where security is backed by real-world resource expenditure, Satoshi Nakamoto solved the seemingly impossible challenge of achieving consensus among untrusted parties across an open network. While debates about energy usage and alternative mechanisms continue, Proof-of-Work’s track record of security and reliability has established it as the foundation of the world’s most valuable cryptocurrency network. The system’s elegant combination of cryptography, game theory, and economic incentives continues to secure hundreds of billions in value more than a decade after its inception. Understanding Proof-of-Work is essential for anyone seeking to comprehend Bitcoin’s fundamental value proposition and the trade-offs inherent in its design. As the system continues to evolve, the core principles of Proof-of-Work remain central to Bitcoin’s identity as a trustless, permissionless, and censorship-resistant form of digital money.